As a results of elevated demands on their providers, fund managers are increasing their uses of multiple primes and contemplating splitting belongings along particular class strains. As for the primes, they’re aggressively increasing the breadth of their services to retain and entice shoppers. Every critical multi-asset dealer should provide its shoppers with leveraged derivatives buying and selling, allowing merchants to discover and interact in place sizes on markets that may in any other case be unavailable to them. The more buying energy purchasers have, the higher your firm’s popularity and general trading expertise.

Firms that need to rely on a quantity of methods for different asset classes face difficulties in terms of cross-asset hedging, risk management, analytics, and reporting. This is because not solely do these systems want to have the ability to communicate with one another in real-time, but in addition because the multi-asset performance of these techniques may be restricted. The goal is to realize when the connection between the two property reverts to its historic norm, leading to features from the long position and losses from the quick position offsetting one another. Pairs trading is taken into account market-neutral as a outcome of it goals to generate returns while minimizing exposure to broader market movements. This strategy requires cautious choice of asset pairs, constant monitoring of their correlation and value movements, and risk management techniques, because the historic relationship between the 2 belongings could not all the time revert as expected.

It also offers higher flexibility and threat management in comparison with specializing in a single asset class. Moving ahead, in a extra institutional-based world, that includes fully integrated technology is ever extra essential to a fund supervisor’s capability to run his enterprise, entice more investor capital, and provide higher and constant returns. Global protection – In search of opportunities, fund managers are increasing their trading to incorporate many global markets. Different mindsetsOne of the largest challenges of this transition is changing a trader’s mindset, notably one who might need traded equities their complete career. They now have to maneuver from their consolation zone to an asset class where terminology, market structure and behavior can be completely totally different to what they know. That is the questionIn current years we’ve seen an trade development, significantly amongst medium-sized asset managers, to contemplate or undertake multi-asset dealing desks in an effort to streamline operations.

Exness Crowned as Best Global Multi-asset Broker at Forex Expo Dubai 2023 – FinanceFeeds

Exness Crowned as Best Global Multi-asset Broker at Forex Expo Dubai 2023.

Posted: Wed, 27 Sep 2023 07:00:00 GMT [source]

As a result, fund managers usually postpone adding a second prime so lengthy as is possible for their business operations. But in a fast paced business, successful managers need to be able to react, even if it means dealing with the challenges of adding extra prime brokers. Protecting their positions – Fund managers expect prime brokers to not compete in the same trades with them and thus don’t like seeing massive proprietary buying and selling desks involved in their strategies.

Luckily, there are a quantity of strategies to do it cheaper, corresponding to using a turnkey answer. You could avoid the potential risks of growing a platform by deploying an acceptable, absolutely ready solution and being up and running inside a couple of weeks. Forex CRM could additionally be used to carry out numerous operations necessary for a smooth brokerage expertise, such as generating new leads, sustaining all processes “under one roof,” IB administrations, dealing with payments, KYC, and other important procedures. You can run VaR throughout your strategies to evaluate the combined danger and run user-defined situations to shock the market and volatility.

By investing in different asset classes, such as stocks, bonds, currencies, real estate, and commodities, buyers can cut back the impression of poor efficiency in one asset class on their general portfolio. Small fund managers can usually depend on a single prime broker to fulfill their technology needs. They sometimes complement their prime’s service with a sequence of spreadsheets that monitor and manage operations and day by day needs. Larger hedge funds (those with more than $1 billon in AUM) reported utilizing more than 4 prime brokers3, based on Global Custodian. This is, on common, twice as many prime brokers as utilized by these under $1 billion (just underneath two prime brokers) and thrice greater than these under $100 million (on common 1.three prime brokers).

Senior Management

We have examined and built-in Condor Multi-Asset Pro to several liquidity hubs in the FX and Crypto markets the place we expect to earn volume-based fees. Another example of purchasers inspiring us was the “ESG Olympics” organised by three foundations. This was a public funding administration tender that challenged would-be managers to impress the judges with their environmental, social and governance (ESG) integration and impact.

The trader’s room ought to embody trading evaluation, which helps to enhance trading strategies. The trader’s room is designed to give merchants final management over their buying and selling actions. Your top priority is to rise up and operating shortly with the least expense and to test your strategies. After that, issues function effectively till you notice you’re not getting the most effective level of support as a result of your account is simply too small.

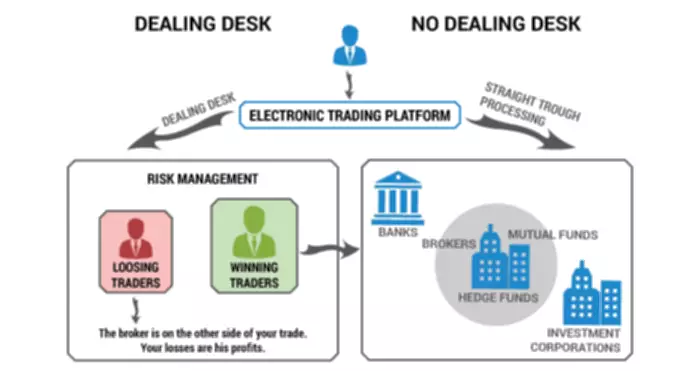

At the tip of the article, we are going to share key steps to attract clients and develop your dealer enterprise in the lengthy run. Successful brokers acknowledge the significance of staying ahead in a aggressive panorama. By configuring an execution mannequin that aligns with their target market, regulatory obligations, and consumer preferences, brokers can establish a stable basis for long-term success and build lasting relationships with their clientele. By using the Liquidity Bridge, brokers can optimize order routing, guaranteeing orders are executed swiftly and efficiently. The Bridge connects a number of liquidity suppliers, allowing brokers to route orders to the most suitable provider based mostly on value, velocity, and order dimension.

- Naturally, any change of this nature has main implications for a business and doesn’t come with out risks and challenges.

- In conclusion, an all-in-one cross-asset OEMS platform presents many benefits to firms buying and selling FX, regardless of whether they are a model new start-up hedge fund or an established institutional asset manager with multi-billion greenback AUM.

- Check the volume ranges accessible across various asset courses supplied by different revered brokers to see what it should appear to be.

- Some brokers go for hybrid models that combine the strengths of a number of execution models.

As the market evolves, main prime brokers are expanding their services to integrate their establishment’s offerings, with the purpose of establishing themselves as a “one-stop-shop” service. Investors may incessantly try to restructure their portfolio to seize these cyclical performances, allocating capital to the asset courses, sectors, locations, or instruments with essentially the most vital potential for returns. This is known as tactical asset allocation, an lively strategy that necessitates access to varied financial instruments and, ideally, several asset classes.

Meet Vantage Prime – Proud Gold Sponsor At Ifx Expo Dubai 2024

Schroder Fund Advisors LLC (“SFA”) is a wholly-owned subsidiary of SIMNA Inc. and is registered as a restricted objective broker-dealer with FINRA and as an Exempt Market Dealer with the securities regulatory authorities in Canada. SFA markets sure funding autos for which other Schroders entities are investment advisers. For instance, if a foreign money publicity arises from a pairs or basket commerce, it can be offset automatically via an FX hedge transaction within the appropriate FX liquidity pool. This is a much more efficient course of than having customers switch between platforms to execute trades. Buy facet corporations wishing to access FX liquidity in today’s markets face a number of challenges. This is especially true if they’re managing a multi-asset fund, running strategies that include an FX part operating alongside other asset classes.

If you’ve a social media plan in place, you ought to use these channels to stay in contact along with your audience and assess how your small business is doing online. Using related instruments, you can see current and historic mentions of your brand or product. Ensure to arrange your model and material accurately, make eye-catching covers with first rate descriptions and titles, use tags where essential, and so on.

Last yr, the iFX Expo Asia 2022 was the first iFX event in Asia since Covid and has been a large success and a tremendous event for Centroid Solutions! The occasion is a must-visit because it gathers all trade individuals from the whole SE Asia region and past. It is an efficient platform to fulfill and engage with potential prospects, partners, and business consultants, in addition to sustain with the most recent developments and innovations of our industry. Third, like all business we have cultural legacies (practices, mindsets) that hamper change and innovation. For instance, it is extremely exhausting for finance professors and funding professionals to envisage a special aim than alpha maximization or tracking error minimization – even when influence is explicitly indicated as an important objective.

It rides a few of the same rails we have at present, however there are some new ones, this person mentioned. For the purchase facet, multi-asset buying and selling provides the promise of efficiencies, value financial savings, and closer alignment with an more and more interconnected global marketplace. We are aggressively signing licensing agreements and onboarding brokers to our trading platform. Ours is an distinctive Company with a unprecedented team of industry experts and a promising future.

Meet Funderpro– Proud Platinum Sponsor At Ifx Expo Dubai 2024

You can go the additional mile and ask us (and our competitors) ambitious questions, difficult us to get higher. So, in asking this question, this pension fund was not only improving the results of its investments, nevertheless it was also influencing us and doubtlessly different shoppers. With increasing shopper demand for better societal outcomes, we spend more time on it. Some shoppers problem us to such a strong diploma that they inspire us to develop new and extra rigorous methods. For some of our shoppers among foundations and charities, the answer is a resounding no. In their view, we’re in the good place to shift capital away from harmful activities towards those that remedy these challenges.

In addition to aforementioned factors, a Multi-Asset project will continually require some customization of the trading platform as a result of each market has it’s own unique requirements, processes and so on. So it shouldn’t be an issue if platform was developed in-house however in case if it was taken from a vendor, dealer must be sure that vendor is able to present an ongoing customization service. Important point Multi-Asset Broker right here is that traders who’re used to work with change traded merchandise have already got habits to use sure tools for his or her trading and analytical activity. FDC presents a full suite of multi-asset buying and selling know-how infrastructure and Software Solutions at a competitive value.

To make sure, our brightest days are earlier than us; we look to execute our go-to-market strategies, seek strategic acquisitions, build business partnerships, and improve shareholder worth. FDC develops all elements of know-how infrastructure in-house and assigns a devoted group and a senior developer to each shopper. Legacy financial companies want infrastructure modernization, rapid implementation of digital fintech capabilities, unique end-user experiences, minimize technical errors, and expertise in development of future-proof fintech options. The great thing is, as soon as purchasers have influenced us, it not only affects our relationship with those particular purchasers but has a lot broader results. So, if you’d like better societal outcomes out of your investments, please assume past the technicalities of the portfolio itself.

How Do You Start Your Individual Multi-asset Brokerage Firm?

By working with suppliers at a holistic level, we’ve been in a position to standardise processes, particularly when in phrases of data structures. For instance, an equity or mounted earnings dealer might sometimes conclude the order once it has been executed. By linking these transactions and successfully allowing one desk to transact both of these it has provided larger visibility throughout the trade life cycle, while decreasing slippage. In addition, by adopting a consolidated method to technology, the value of implementation has been lower and, crucially, easier.

Willem Schramade explains the position shoppers can play in serving to to create investment options to societal issues. Keywords should be utilized in articles while retaining a well-organized format, fashion, and tone that appeal to readers. Creating new and contemporary content material is an efficient method to interact with your visitors; nevertheless, additionally it is a good idea to use earlier articles and make links to them to enrich new posts and generate an enormous hyperlink structure. As a end result, folks on the lookout for your services or products, as nicely as those in search of data on the trade business, will find your web site. B) Ensure that clients have multiple fiat and cryptocurrency help to work freely and conveniently with each mediums of trade. An organizational function for users is essential for getting probably the most profit from multi-asset buying and selling.

Multi-asset trading – the power to commerce a number of asset lessons on a single electronic platform – has moved from an business buzzword to a extensively accepted trading mannequin in only a few years. On the other side, prime brokers have long talked about an open structure platform to assist hedge funds’ needs for having multiple primes. Most have accomplished nothing (clearly it isn’t of their greatest interest to make it straightforward for their fund managers to add second and third primes). For example, Goldman Sachs and Morgan Stanley (who command the primary two spots and more than 60% market share), provide no know-how to their hedge fund shoppers to assist electronically executing trades with different prime brokers. As corporates turn to ever more complex buying and selling strategies and search larger efficiencies in phrases of market connectivity and access to liquidity, all the points outlined on this article will play a job in choosing an acceptable trading system. The key point that corporates might want to remember is that their necessities will change over time and it may be very important issue this into the planning.

You change to a platform allowing you to route your fairness orders to a dealer gateway. Your futures and crypto orders are despatched directly to the trade utilizing a devoted gateway and trade connection on a server collocated at the trade. As a end result, you possibly https://www.xcritical.in/ can trade a quantity of asset classes, successfully unfold across products and exchanges, and your small business begins to take off. Additionally, fund administrators don’t usually have acceptable tools to facilitate these issues.